German automaker wants to regain market share in China with more affordable cars

11 hours ago

- VW has joined forces with China’s Xpeng to develop EV architecture.

- New platform will reduce VW’s costs and make it more competitive in China.

- VW has lost ground to local rivals and needs to recover market share.

Volkswagen and Xpeng are collaborating on a new EV platform that the German automaker hopes will reduce its production costs and help it recover market share in China.

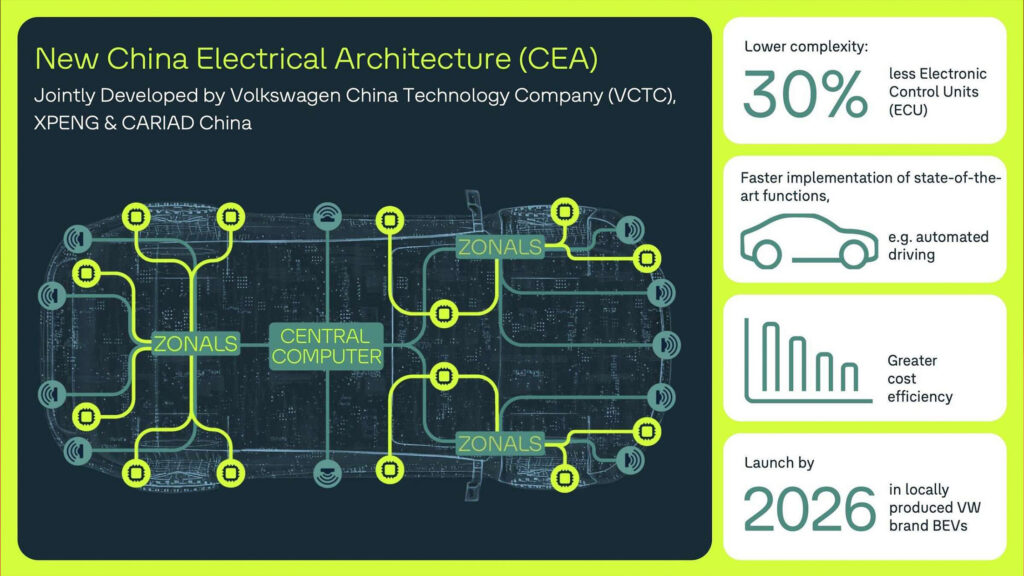

Execs in Wolfsburg think the new China Electrical Architecture (CEA), which is a joint project between Xpeng and VW’s subsidiaries, Volkswagen China Technology Company (VCTC) and CARIAD China, will slash costs by as much as 40 percent compared with the current MEB platform used in cars like the ID.4, and make VW’s EVs as affordable as those from Chinese brands.

Related: VW To Spend $2.68 Billion Into Chinese Hub For Faster EV Development

The cost saving comes in part from a 30 percent reduction in the number of electronic control units. A centralized computer system and zonal structure of sub-systems also makes it easy for VW to apply over-air updates and implement new technologies like autonomous driving features that can be continually and seamlessly updated.

VW will launch the platform onto the Chinese market in 2026 in the form of two mid-range vehicles, the first of which will be an SUV. But that same year VW will also debut a second China-only platform developed jointly by Volkswagen China Technology Company (VCTC) together with SAIC Volkswagen and FAWVolkswagen. This China Main Platform (CMP) architecture is designed for more affordable cars than the CEA will host, and will initially result in four smaller VW-branded models.

This isn’t the first time VW and Xpeng have shared headlines. Last year the German automaker acquired a 4.99 percent stake in the Chinese firm for around $700 million as part of a plan to reverse its flagging fortunes in China. VW was a mighty presence there for decades, and the first Western brand to exploit the sales and manufacturing possibilities the country offered, but it has struggled recently against increasingly competent and aggressively-priced local opposition as well as Tesla.

VW’s China boss Ralf Brandstaetter pulled no punches in explaining why the automaker badly needs this deal. “Competition is very fierce, and we have to adapt our cost structure to be competitive in this environment,” Brandstaetter told reporters according to Reuters .