Automakers are missing out on a significant pool of buyers by focusing on big, expensive EVs

- Survey shows that automakers are struggling to meet the needs of buyers who are interested in EVs.

- Consumers want cheaper EVs, and the lack of affordable options may be driving away young customers.

- Despite the wealth of electric pickup trucks on the market, EV buyers aren’t particularly interested in trucks, and pickup owners don’t want an EV.

Many automakers, both legacy and startups, overestimated the pace at which the electric vehicle segment would continue to grow, causing many to scale back their investments in the technology to align with demand. Now, new research suggests that they misunderstood consumers’ true desires regarding EVs.

Some of the disconnect between what buyers want and automakers can offer comes down to market factors beyond the industry’s control. Leading up to the pandemic, many brands were fighting to go upmarket, adding more technology to their cars and making them more luxurious. However, the global event resulted in significant inflation, among other factors, rendering many of these new premium vehicles unaffordable for the average buyer.

Read: No One Told EV Owners Their Tires Will Wear Faster, And That’s Making Them Unhappy

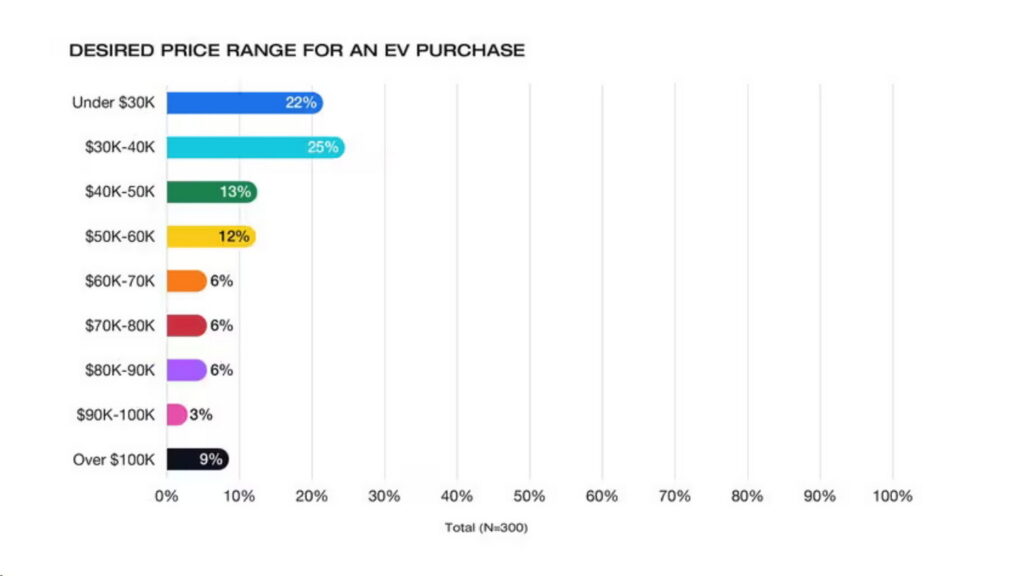

That couldn’t have occurred at a more inconvenient time for the EV industry, which had pinned its hopes on innovative technology and hefty price tags to offset the substantial investments in EV powertrains. However, according to Edmunds, today’s EV buyers are exceptionally price-sensitive.

Almost half of those intending to purchase an EV (47 percent), as per the outlet’s survey, express a desire for a vehicle priced below $40,000, with 22 percent aiming for a price tag under $30,000. Unfortunately, there are limited options available for these prospective buyers.

While we all want vehicles to cost less, the issue of affordability may be particularly acute for the EV segment. Younger people, who tend to have less buying power, are the ones most interested in EVs. Surveys reveal that 90 percent of 18-to-24-year-olds are open to an EV as their next vehicle, and 83 percent of 24-to-34-year-olds say they would consider one. However, if they can’t afford an EV, automakers may not be able to convert that interest into sales.

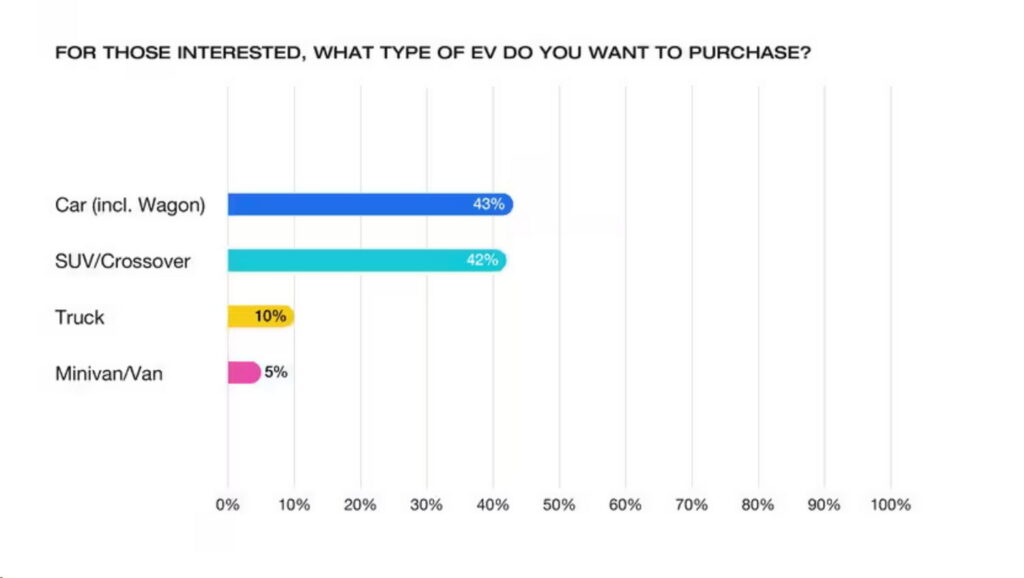

On the other hand, what EV buyers don’t want is a pickup truck. Edmunds reports that just 10 percent of survey respondents say they want a pickup, while 43 percent were interested in a car, and 42 percent were open to an SUV or a crossover. Meanwhile, 39 percent of pickup truck owners say they would not consider an EV, despite having many options to choose from.

Pickups might also be less appealing to automakers. Ford’s CFO recently acknowledged that EVs challenge many brands’ conventional expectations. In the realm of internal combustion vehicles, larger models typically translate to higher profits, as their manufacturing costs are relatively low compared to their selling prices. However, the rising cost of batteries means that producing large EVs becomes considerably more expensive, thereby diminishing potential profits.

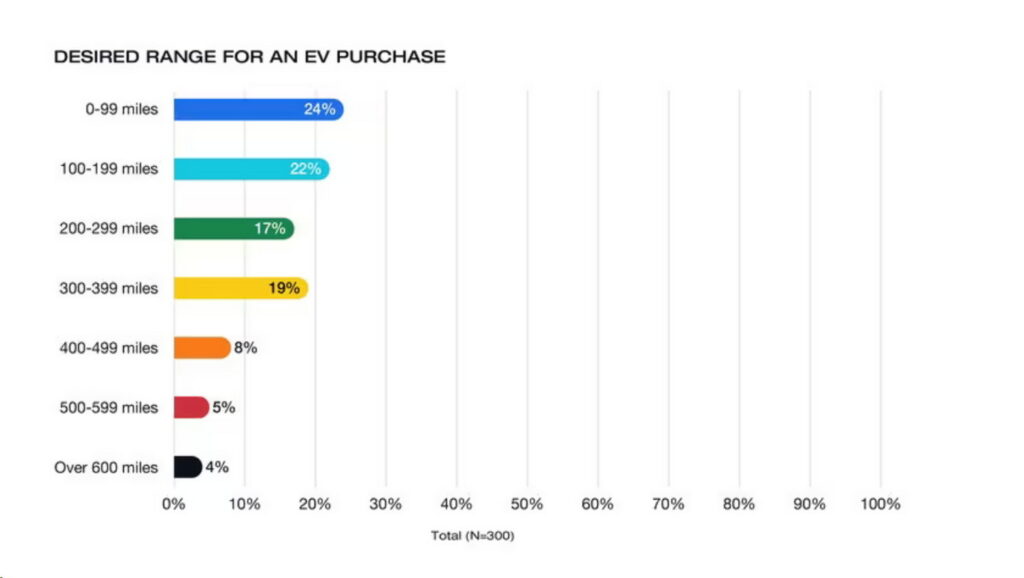

Fascinatingly, those big, expensive batteries might not even be a selling point, as range anxiety is much less of a concern than many might presume. More than 45 percent of consumers said they would be comfortable with an EV that had 200 miles (322 km) of range or less, and nearly a quarter said they would be comfortable with an EV that had less than 100 miles (161 km) of range.

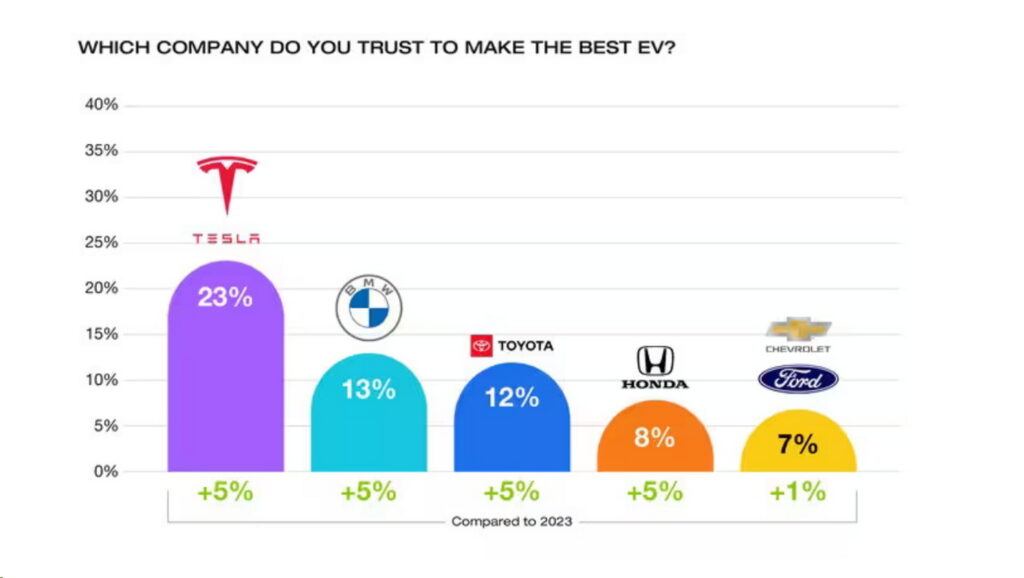

The disconnect between consumer preferences and available options goes deeper, too. Although consumers express the most trust in Tesla for producing EVs, Toyota and Honda also rank highly (third and fourth, respectively, with BMW in second place), despite their limited EV offerings. Conversely, Kia and Hyundai were ranked poorly, despite the fact that they offer a variety of smaller EVs with solid performance.

Since the rise of modern EVs is a relatively new phenomenon, it isn’t a huge surprise that automakers are struggling to meet consumer expectations. However, with the segment’s growth expected to slow in 2024, as new regulations come in to make EVs more important, it will be crucial for the industry to get a handle on what consumers really want, and to not waste resources electrifying the wrong segments.